Ride the Boom in Kansas City

Named as one of the top ten housing markets for buyers to consider, Kansas City boasts recent performance statistics in the real estate market that are impressive. Growth and demand are both booming; active listings have decreased by almost 50%, and median sales prices are up by nearly 15% over the last year.

Kansas City is the largest city in Missouri, located at the meeting point of the Kansas and Missouri Rivers. Many factors keep the housing market in KC strong, two of which are a pro-business government and a lively, diverse economy.

From the suburbs to the downtown area to the outlying areas, there’s a real estate boom in Kansas City, and you might want to hop on the next ride out there.

Kansas City’s Population: Fueling the Boom

Throughout the metropolitan area, there are 2.1 million residents, with about 500,000 in Kansas City itself. The population has grown faster than in cities like Cleveland, Cincinnati, and St. Louis. Year over year, the number of people who call the area “home” has increased 0.73%.

People moving to Kansas City from other areas of the country account for half of the population growth. By 2040, the city is expected to add 400,000 more residents. These new residents are swiftly claiming new homes in KC, especially those in the mid-price range.

Real Estate in Kansas City, Missouri

Building permits were up by 15% in September 2021 compared to the same time the previous year. In addition to the population influx, the rising costs of construction and materials have made resale homes an attractive option for buyers, further increasing the demand for single-family homes in the area.

Over the past five years, home values have increased by a whopping 59.3%. The median list price of a single-family home is $199,900. All this growth is excellent news for homebuyers and real estate investors, especially investors interested in buying turnkey properties in Missouri to reap the benefits of passive income rentals.

Turnkey Property Investment Presents a Prime Opportunity in KC

There has never been a better time to buy turnkey rentals in Kansas City. The average rent is $1,071, and rents in the city have increased 4% year over year. Forty-six percent of all occupied housing units consist of renter-occupied households, so landlords and would-be rental property owners would be wise to get in on such a lucrative and expansive rental market.

Turnkey properties in Kansas City provide an opportunity for significant passive income and much bigger long-term returns than many other investments. The advantages of turnkey rental property ownership are substantial and include:

- Protection against inflation

- Tax deductions

- Passive income cash flow

- Equity buildup

While investors mainly focus on how much income they can gain from passive income rentals, Missouri turnkey properties offer many additional boons.

Protection Against Inflation

Inflation, an ever-present economic reality, can significantly erode purchasing power over time. However, turnkey property owners possess a unique advantage in this regard. As inflation increases, landlords have the ability to adjust rent prices upwards to match or exceed inflation rates, effectively protecting their income stream against the diminishing value of money. This capability is particularly advantageous when paired with a fixed-rate mortgage, where monthly payments remain constant regardless of inflationary pressures, allowing property owners to enjoy greater profitability as rental income rises but expenses stay flat.

Tax Deductions

Owning turnkey properties also comes with considerable tax benefits. Virtually all expenses associated with managing these properties are tax-deductible, which can lead to significant savings. These expenses include, but are not limited to, commissions, marketing fees, property management fees, repair costs, and the depreciation of property and appliances. Such deductions can lower the overall tax liability for owners, improving the investment’s return on income and reducing the out-of-pocket costs associated with property upkeep and management.

Passive Income Cash Flow

One of the most attractive features of turnkey property investment is the generation of steady, passive income. This type of investment allows landlords to receive a continuous cash flow without the need for active management or laborious involvement. By adjusting rental charges in line with inflation, landlords ensure that their passive income not only covers all necessary expenses—such as mortgage, insurance, taxes, and maintenance fees—but also generates surplus funds. This surplus can be saved, reinvested, or used to improve financial security, offering a cushion that can grow over time.

Equity Buildup

Investment in turnkey properties often leads to rapid equity buildup. This happens as the property value appreciates while the mortgage balance decreases over time. In markets like Kansas City, where the real estate market is booming, properties can appreciate at an accelerated rate. This rapid appreciation, coupled with regular payments reducing the mortgage principal, allows investors to build substantial equity in a relatively short period. This equity can then be leveraged for additional investments, further property purchases, or other financial ventures, providing a powerful tool for wealth accumulation.

Kansas City Turnkey Properties

Kansas City stands out as a premier location for investing in turnkey properties due to its strong job market, educational opportunities, vibrant business environment, and affordable housing. The city’s cost of living and tax burden are both below the national average, making it an even more attractive place for real estate investment. With its housing market on a steady upward trajectory, the potential for property appreciation and robust rental demand looks promising for the foreseeable future.

For those interested in exploring the lucrative opportunities that Kansas City has to offer, partnering with a leading turnkey rental company like Real Deal Properties can provide significant advantages. Such companies offer deep local market insights and a portfolio of high-quality properties, ensuring investors can capitalize on the best real estate opportunities available.

Whether you are an experienced investor seeking to expand your portfolio or a newcomer to the real estate market, Kansas City offers a thriving environment for turnkey property investments that promise both immediate returns in terms of passive income and long-term gains through property appreciation and equity buildup.

Gain Financial Freedom Today

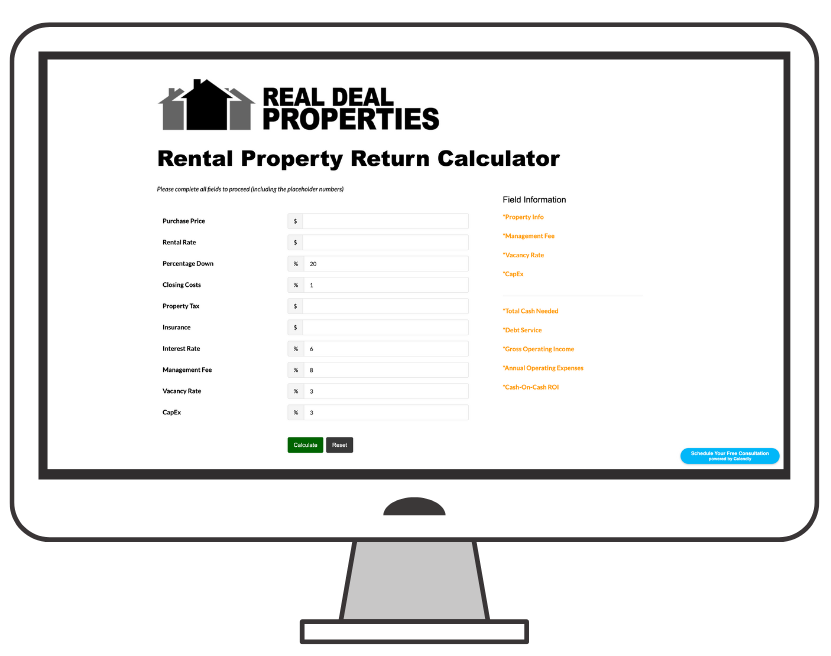

Our turnkey investment rental properties will earn you passive monthly income and move you toward your financial goals.

We’ll never share your information with anyone.