Understanding Rental ROI

Investing in real estate, particularly rental properties, is a proven method to generate passive income and grow wealth. Yet, making informed decisions hinges on understanding the dynamics of Return on Investment (ROI). This article dives into determining what constitutes a strong ROI and various strategies for evaluating and improving your rental investment returns INCLUDING, how to use a rental return calculator (and where to find ours).

Introduction to ROI in Real Estate

ROI measures the efficiency and profitability of an investment, crucial for both individual investors and property management companies. In the context of rental properties, it relates the net income generated to the overall amount invested. Understanding this ratio helps in maximizing the profitability of real estate investments.

Return on Investment (ROI) is a fundamental metric that evaluates the efficiency and profitability of an investment, making it essential for both individual investors and property management companies alike. In the context of rental properties, ROI is particularly significant as it directly correlates the net income generated from the property to the total capital invested. This ratio not only indicates the financial performance of the property but also serves as a critical benchmark for comparing the viability and attractiveness of different real estate investments.

Calculating rental investment ROI involves assessing both the gross income produced by the property and all associated costs, including purchase price, renovation expenses, ongoing maintenance, and management fees. By subtracting these expenses from the total income and then dividing by the total investment cost, investors can obtain a percentage that reflects the annual return on their initial investment. This figure allows investors to gauge whether the potential returns align with their investment goals and risk tolerance.

Moreover, a comprehensive understanding of rental ROI helps investors make informed decisions about purchasing new properties, enhancing existing ones, or reallocating their resources to more profitable ventures. It is also invaluable for property management companies tasked with optimizing the performance of rental assets under their care. These companies use ROI calculations to justify renovations or other changes that could increase rental income or reduce costs, thereby improving the overall profitability of the properties they manage.

In essence, mastering the nuances of rental return ROI in rental property investments is crucial for maximizing profitability and making strategic decisions that enhance the value and income-generating potential of real estate assets. Whether you’re an experienced investor or just starting out, a deep understanding of an investments ROI can provide a solid foundation for achieving long-term success in the real estate market.

Calculating ROI: Different Approaches and Their Uses

There are several methodologies to calculate ROI, each providing unique insights:

Annual Cash Return: This straightforward method involves subtracting annual expenses from the total yearly rental income, then dividing by the investment’s total cost.

Annual Cash Return = (Yearly Rental Income − Annual Expenses) / Total Investment

Cash Flow Analysis: Here, focus is on the monthly surplus after covering all operating costs:

Monthly Cash Flow = Monthly Rental Income − Total Monthly Expenses

An example would be deducting monthly expenses from a rental income of $1,500 to gauge the net cash flow.

Operating Income Ratio (OIR): Similar to NOI, OIR considers the effective income after operational costs but before financial servicing:

OIR = Net Operating Income / Total Operational Expenses

Leverage Return: A refined version of cash-on-cash return, this measure includes financing costs in its calculation to provide a clearer picture of profitability when using borrowed funds.

Leverage Return = Net Cash Flow After Financing / Initial Cash Outlay

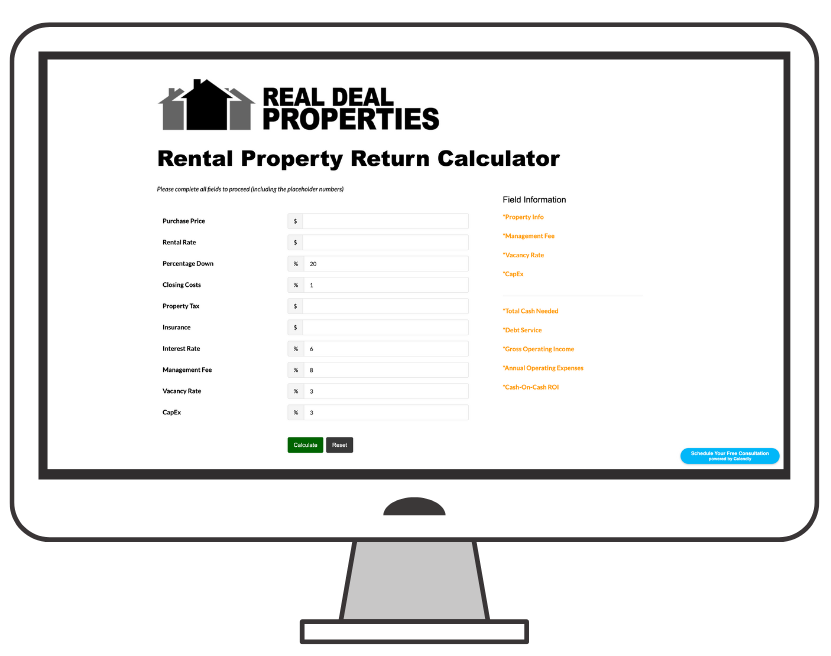

Where to find a RENTAL RETURN CALCULATOR?

Well lucky for you, we went out and made one that you can use for free! We were sick of using spreadsheets or searching forever just to find a reliable source on the internet so we went ahead and had our custom rental return calculations applied to an easy-to-use, online calculator that you can use right from your phone or desktop. Check out the link below:

Benchmarking Successful Rental Investments: What is a Good ROI?

Defining a “good” Return on Investment (ROI) for rental properties is inherently subjective and influenced by a multitude of factors. The specific characteristics of the property, such as its location, the prevailing market trends, and the overarching investment strategy pursued by the investor, all significantly impact what constitutes a satisfactory ROI for your rental. Generally, an ROI in the range of 8% to 12% is considered favorable and indicative of a solid investment. However, more ambitious investors might set their sights on even higher returns, depending on their risk tolerance and financial goals.

The location of the property is a critical determinant of investment rental ROI, as it directly affects both the rental income potential and the likelihood of property appreciation. Properties situated in high-demand areas or emerging markets often promise higher ROIs due to stronger rental demand and potential for significant appreciation. Conversely, properties in stagnant or declining areas might not yield the expected returns, even if purchased at a lower price point.

Market trends also play a crucial role in shaping ROI. Factors such as changes in the local economy, shifts in demographic patterns, and developments in local and national real estate markets can all influence the profitability of a rental investment. For instance, a growing job market in a particular city can lead to increased rental demand, thereby pushing up both rental prices and property values, which in turn boost ROI.

Furthermore, the investment strategy adopted by an investor can greatly affect the ROI. Some investors might prefer a conservative approach, opting for properties that offer stable but modest returns with less risk of vacancy. Others might adopt a more aggressive strategy, investing in properties that require significant upfront renovations but promise higher long-term yields due to their improved condition and appeal.

Beyond the numerical ROI, other qualitative factors such as property appreciation potential, neighborhood growth, and overall economic stability are essential for a holistic assessment of an investment’s performance. Appreciation potential can offer a significant boost to ROI if the property value increases over time, either through natural market progressions or specific improvements made to the property or area. Similarly, investing in a neighborhood poised for growth due to upcoming infrastructure projects or commercial developments can enhance the long-term profitability of a rental property.

In summary, while a numeric ROI of 8% to 12% is typically seen as desirable, understanding and evaluating broader economic and market conditions, as well as aligning with one’s investment strategy and risk profile, are crucial for truly defining what a “good” ROI looks like for each individual investor.

Pre-Investment Analysis: Why It’s Crucial

Thoroughly analyzing ROI before making a property investment is essential for several reasons:

- Assess Potential: It enables investors to estimate the income-generating potential of the property.

- Define Financial Goals: Understanding ROI helps in setting realistic investment goals and assessing risk levels.

- Investment Comparison: It allows investors to compare different real estate opportunities objectively.

- Optimization Opportunities: Identifying underperforming areas that could be enhanced to boost returns.

Conducting a thorough analysis of the rental return rate before making a property investment is indispensable for several critical reasons. Firstly, it enables investors to assess the potential income generation of the property accurately. By calculating anticipated returns, investors can gauge whether a property meets their financial expectations and investment criteria, helping them to avoid assets that are less likely to produce satisfactory yields.

Furthermore, understanding ROI is vital for defining and refining financial goals. This analysis helps investors set realistic objectives based on expected income and risk levels, aligning their investment strategies with their long-term financial planning. It acts as a guiding metric that can influence how much to invest, the type of properties to target, and the timeline for achieving investment returns.

ROI analysis also facilitates objective comparison between different real estate opportunities. With a clear ROI calculation, investors can place various investment options side by side to evaluate which properties offer the best returns relative to their cost and risk. This objective measurement helps eliminate emotional or biased decisions, focusing instead on hard data to guide investment choices.

Lastly, a detailed ROI calculation can highlight optimization opportunities within a property investment portfolio. By identifying areas where properties are underperforming, investors can make targeted improvements, whether through physical property upgrades, changes in management strategies, or adjustments to rental terms. Enhancing these aspects can significantly boost the property’s income generation and overall ROI, ultimately increasing the investor’s profitability and asset value. This proactive approach not only helps in maximizing returns but also in maintaining competitive edge in the dynamic real estate market.

Boosting Your Investment’s ROI Through Strategic Management

Optimal management is key to maximizing ROI. Effective property management involves:

- Efficient Operations: Streamlining processes to reduce costs and increase operational efficiency.

- Tenant Satisfaction: Ensuring tenant satisfaction to reduce turnover rates and vacancy periods.

- Preventive Maintenance: Implementing a schedule for regular maintenance to avoid costly repairs and maintain property value.

ROI is a critical metric in evaluating the success of rental property investments. By understanding and applying various ROI calculation methods and enhancing property management strategies, investors can significantly improve their returns and ensure the long-term success of their real estate investments.

Gain Financial Freedom Today

Our turnkey investment rental properties will earn you passive monthly income and move you toward your financial goals.

We’ll never share your information with anyone.